Published

Blog type

For most finance students, we probably had the dream of being a portfolio manager for an asset firm or working on a busy, chaotic trading floor for an investment bank. That was certainly true of me, and that’s why I was attracted to this opportunity of participating in the asset management simulation held by Imperial College Business School Finance Club and AmplifyME.

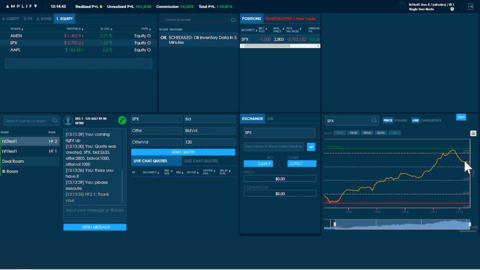

AmplifyME provides financial training (supported by Amplify Trading) and this simulation has been used by many finance companies such as Morgan Stanley, Bank of America and Credit Suisse to train graduate hires. This simulation can track many indicators required in the real trading world.

The event reminds me of my days as an undergraduate studying finance when I kept hearing that you need to beat the benchmark to maximise returns. Even though I’m studying MSc Innovation, Entrepreneurship & Management, which is not a finance programme, I thought this would be a good opportunity to sharpen my skills.

The simulation

The simulation was in two parts: in first part we acted as an asset manager and in the other we acted as a sales trader. Throughout the simulation, half of us were on the sell side and were the sales traders in the investment banks facilitating trade and the other half were on the buy side and were the asset managers trying to make the most returns.

In the first half, I was given the sales trader role which I found very easy but also stressful. The stressful part was constantly responding to clients and meeting their demands. I remember my fingers typing quickly as I was constantly talking to multiple clients at the same time.

For the sales side, it was very easy to accumulate a large number of shares from different companies when everything was fast-paced. However, you also needed to give away all the shares you owned/shorted in small amounts so that your transactions wouldn’t make a huge impact on the stock market. Another aspect was maintaining good relationships with clients and providing the best deals possible.

Even though there was also an exchange place where asset managers could make transactions based on reference prices, the exchange had a much wider spread for the price, e.g. the reference price might be £2711.10 while the exchange price is between £2304 (bid) and £3117 (offer). Therefore, asset managers would like to deal with investment banks to get a much smaller spread.

During the simulation, I kept seeing some familiar names coming around and I felt very happy to retain the clients. Another key indicator for traders is fat finger count, which is how many pricing or execution errors you made, and I’m very proud to say, I made zero mistakes throughout the simulation.

My learnings from the simulation

Being an asset manager is much more difficult than being a sales trader in my opinion. This is because there are many factors influencing the stock market, such as politics and economic environment, and you also need to keep an eye on the company’s performance.

It’s very important to react very quickly to different sources of news and make decisions. How well you perform is also dependent on the sales side — how fast the traders can respond to you as well as how good of a deal you can get from said traders.

Unfortunately, I think everyone was exhausted during the first round and not many investment banks responded to my messages, and I ended up doing most of the transactions on the exchange. Another difficult aspect of asset management in this simulation was that everything seemed to be short-term (within 30 minutes) and that’s where I got lost in the theories.

It was a very exciting simulation. I think I can be a good trader for an investment bank as I got 79% for this simulation. This experience helped me understand the real working environment in banking and now my financial theories are not only theories on paper but also skills in the real world. Hopefully I can combine it with my entrepreneurial knowledge to help the industry develop in the future.

I’m very grateful to the Finance Club and AmplifyME for providing this simulation and I highly recommend that finance students — or even just students with finance knowledge — participate in this event if they are interested in banking.