Advanced Methods in Derivatives Pricing (H. Zheng)

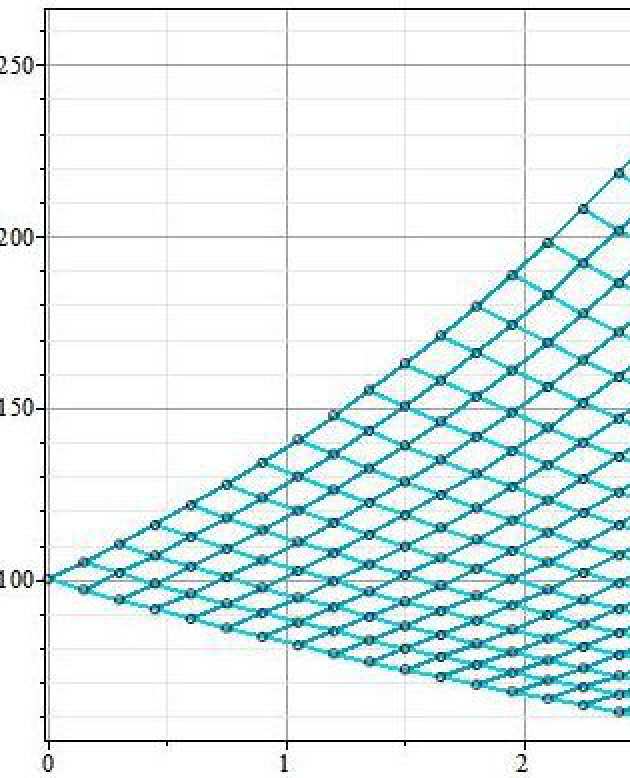

This course explores the mathematical aspects of derivative security valuation and hedging based on the 'no-arbitrage' principle. Starting with the Black-Scholes paradigm and construction of perfectly-replicating portfolios, the connection between absence of arbitrage and the existence of martingale pricing measures is explored in detail. Applications to 'exotic' options involving such features as path-dependency, multi-currency payoffs, multi-factor models and early exercise options are covered.

Computing in C++, Part I: Programming in C (R. Nurnberg)

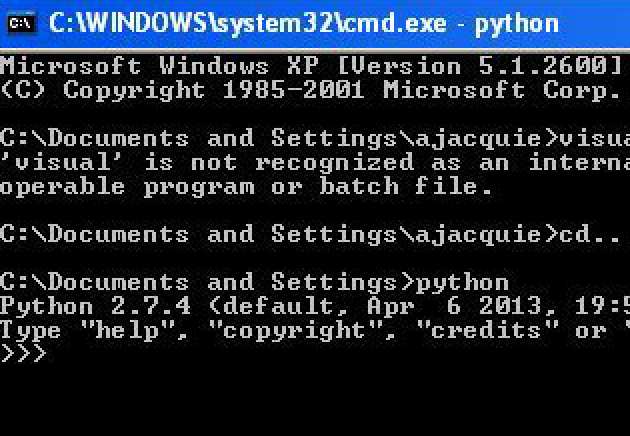

This non-assessed course will give an introduction to the programming language 'C'. No programming experience in C is required to follow this course. Attending this course will help students complete the practical assignments of other courses. It will be followed in the second term by an introduction to Object Oriented Programming in C++.

This non-assessed course will give an introduction to the programming language 'C'. No programming experience in C is required to follow this course. Attending this course will help students complete the practical assignments of other courses. It will be followed in the second term by an introduction to Object Oriented Programming in C++.

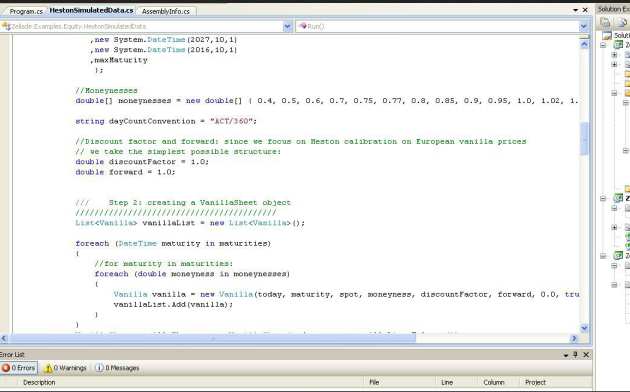

Computing in C++, Part II: Object oriented programming (R. Nurnberg)

The course gives an introduction to object oriented programming in C++. In contrast to structured programming, where a programming task is simply split into smaller parts, which are then coded separately, the essence of object oriented programming is to decompose a problem into related subgroups, where each subgroup is self-contained and contains its own instructions as well as the data that relates to it. Starting from the simple concept of a class that contains both data and methods relating to that data, the course will cover all the major features of object oriented programming, e.g. encapsulation, inheritance and polymorphism. To this end, the course will address operator overloading, virtual functions and templates.

The course gives an introduction to object oriented programming in C++. In contrast to structured programming, where a programming task is simply split into smaller parts, which are then coded separately, the essence of object oriented programming is to decompose a problem into related subgroups, where each subgroup is self-contained and contains its own instructions as well as the data that relates to it. Starting from the simple concept of a class that contains both data and methods relating to that data, the course will cover all the major features of object oriented programming, e.g. encapsulation, inheritance and polymorphism. To this end, the course will address operator overloading, virtual functions and templates.

Interest Rate Models with Credit Risk, Collateral, Funding Liquidity Risk and Multiple Curves (D. Brigo)

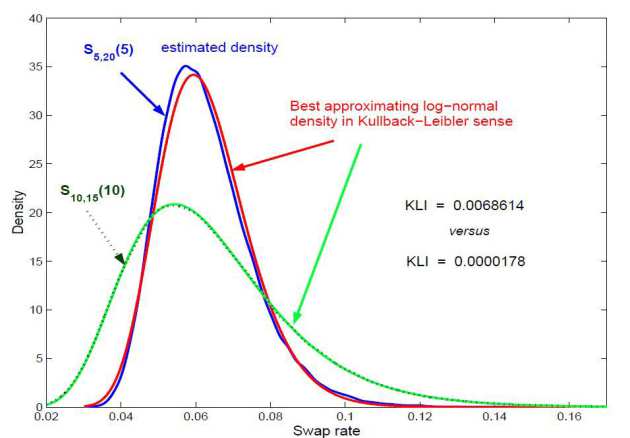

This is a course that deals with the theory and practice of the term structure of interest rates when including also credit risk, funding liquidity costs, collateral modeling and multiple curves. The paradigm of derivatives valuation is shifting from complex payouts designed on simple single asset class risks to simple products that are now managed by analyzing previously neglected complex and interconnected nonlinear risks. The course starts by briefly putting derivatives valuation into context, in connection also with the onset of the 2007-2008 crisis that prompted many of the changes we are seeing now. The course then moves to classic interest rate models based on a risk free rate, on classical instantaneous forward rates, and on default free LIBOR and SWAP rates, also in presence of volatility smile. Several families of models are introduced and studied in detail, with an eye both to a rigorous theoretical derivation and to practical implementation and calibration. Following the classical part, the increasingly important issues of multiple discount curves, credit risk, credit and debit valuation adjustments, collateral modeling, gap risk and funding liquidity costs are analyzed quantitatively. The related notions of CVA, DVA and FVA are analyzed and criticized in detail, and their significance for the general derivatives valuation paradigm is discussed. The specific case of trading through central clearing (CCPs) is hinted at. Finally, an analysis of Risk measures for interest rate derivatives products is presented, with a case study highlighting the role of correlation and dependence in Risk measurement.

This is a course that deals with the theory and practice of the term structure of interest rates when including also credit risk, funding liquidity costs, collateral modeling and multiple curves. The paradigm of derivatives valuation is shifting from complex payouts designed on simple single asset class risks to simple products that are now managed by analyzing previously neglected complex and interconnected nonlinear risks. The course starts by briefly putting derivatives valuation into context, in connection also with the onset of the 2007-2008 crisis that prompted many of the changes we are seeing now. The course then moves to classic interest rate models based on a risk free rate, on classical instantaneous forward rates, and on default free LIBOR and SWAP rates, also in presence of volatility smile. Several families of models are introduced and studied in detail, with an eye both to a rigorous theoretical derivation and to practical implementation and calibration. Following the classical part, the increasingly important issues of multiple discount curves, credit risk, credit and debit valuation adjustments, collateral modeling, gap risk and funding liquidity costs are analyzed quantitatively. The related notions of CVA, DVA and FVA are analyzed and criticized in detail, and their significance for the general derivatives valuation paradigm is discussed. The specific case of trading through central clearing (CCPs) is hinted at. Finally, an analysis of Risk measures for interest rate derivatives products is presented, with a case study highlighting the role of correlation and dependence in Risk measurement.

Mathematical Finance: an Introduction to Option Pricing Theory (N. Bingham)

This course is an introduction to option pricing theory, a core area of Mathematical Finance, and its mathematical and conceptual underpinnings. The goal is to familiarize students with the tools and methods of continuous-time arbitrage pricing theory, in the setting of the Black-Scholes model. Probabilistic tools - Brownian motion, the Ito integral, stochastic calculus- will be introduced in a self-contained manner and further explored in the Stochastic Processes course.

This course is an introduction to option pricing theory, a core area of Mathematical Finance, and its mathematical and conceptual underpinnings. The goal is to familiarize students with the tools and methods of continuous-time arbitrage pricing theory, in the setting of the Black-Scholes model. Probabilistic tools - Brownian motion, the Ito integral, stochastic calculus- will be introduced in a self-contained manner and further explored in the Stochastic Processes course.

Outline:

- Financial markets. Futures and options. Actuarial pricing vs arbitrage pricing: the example of forward contracts. Absence of arbitrage and the law of one price. Put-call parity and the pricing of forwards.

- The binomial model: self-financing strategies and the Absence of arbitrage principle.

- Pricing by replication. Risk-neutral pricing. The martingale property.

- Brownian motion as a continuous-time limit of scaled random walks. The Black and Scholes model.

- Brownian motion as a Gaussian process. Relation with the heat equation. The Feynman-Kac formula.

- Quadratic variation. Why Riemann integration and ordinary calculus do not apply to Brownian motion.

- The Ito stochastic integral. Gain process of a trading strategy. Ito processes.

- The Ito formula. Dynamic hedging of options in the Black Scholes model. Delta-hedging ane Greeks.

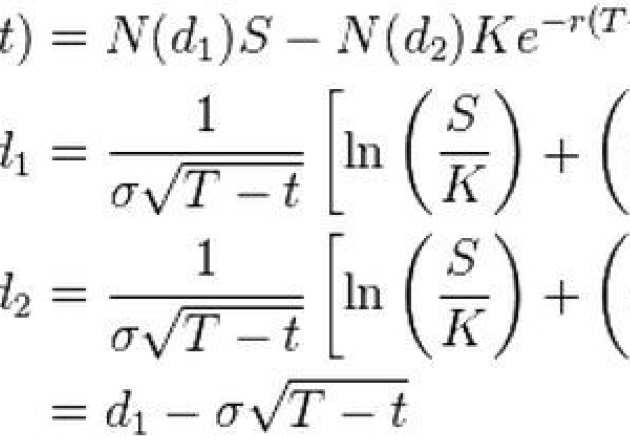

- The Black-Scholes partial differential equation. Black Scholes formula for call and put options.

Quantitative Risk Management (F. Zikes / M. Pakkanen)

Outline:

Outline:

- Risk management and financial returns

Taxonomy of risks, why manage financial risks, the regulatory framework, stylised facts of financial asset returns, a generic model of asset returns - Basic concepts in risk management

Risk factors, conditional and unconditional loss distributions, Value-at-Risk, expected shortfall, coherent risk measures, historical simulation, Monte Carlo, backtesting - Univariate time series and volatility modelling

Linear models, ARMA models, GARCH-type models, specification, estimation and forecasting, applications to equity and FX returns - Volatility modeling with intraday data

Continuous-time models, realized variance construction, range-based volatility measures, intraday data issues, improving volatility forecasts and VaR models with realized measures - Nonnormal distributions and extreme value theory

The distribution of maxima, threshold exceedances, estimating the tail index, tails of specific models, applications to VaR and ES - Multivariate models and dimension reduction techniques

The multivariate normal distribution, testing for normality, normal mixture distributions, spherical and elliptical distributions, factor models, principal components, applications to the term structure of interest rates - Multivariate time series and covariance modelling

Multivariate A RMA processes, multivariate GARCH-t ype models, spec ification, estimation and applications to equity portfolio VaR and ES - Copulas and dependence

Basic properties, dependence measures, popular families of copulas, mixture copulas, conditional and time-varying copulas, specification, estimation and application to a trading book of CDS contracts

Stochastic Processes (T. Cass)

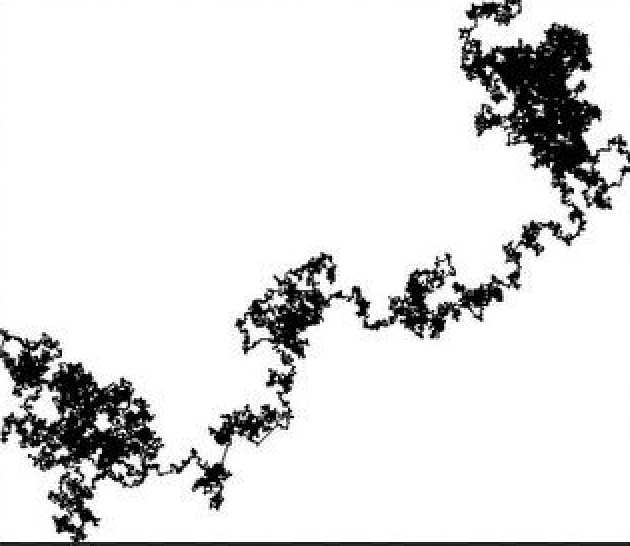

This course gives an introduction to probability theory and measure theory and introduces stochastic processes and the basic tools from stochastic analysis to provide the mathematical foundations for option pricing theory. It includes an intermediate introduction to axiomatic probability theory and measure theory, explaining notions like probability spaces, measures, measurable functions, integration with respect to measures, convergence concepts fo r random variables, joint distributions, independence and conditional expectations. It studies stochastic processes in discrete and continuous time; mainly the random walk, Brownian motion, and their properties. These in turn involve notions like the quadratic variation, the reflection principle, the Markov property and the m arting ale pr operty. We will cover the stochastic Ito integral, the Ito formula, and their mathematical applications; for example, stochasti c differential equations and some references to partial differential equations.

This course gives an introduction to probability theory and measure theory and introduces stochastic processes and the basic tools from stochastic analysis to provide the mathematical foundations for option pricing theory. It includes an intermediate introduction to axiomatic probability theory and measure theory, explaining notions like probability spaces, measures, measurable functions, integration with respect to measures, convergence concepts fo r random variables, joint distributions, independence and conditional expectations. It studies stochastic processes in discrete and continuous time; mainly the random walk, Brownian motion, and their properties. These in turn involve notions like the quadratic variation, the reflection principle, the Markov property and the m arting ale pr operty. We will cover the stochastic Ito integral, the Ito formula, and their mathematical applications; for example, stochasti c differential equations and some references to partial differential equations.

Theory of Finance (M. Pistorius)

This course could be entitled "Basic things everyone working in finance needs to know". It starts with a discussion of interest, the term stucture of interest rates, and concepts relating to fixed-income securities. Elements of probability theory are reviewed, followed by mean-variance portfolio theory---the basic trade-off between risk and return described by Markowitz---and the Capital Asset Pricing Model (CAPM). We then discuss the representation of investor preferences in terms of expected utility, and move on to describe the relationship between linear pricing, arbitrage and portfolio choice. The final part of the course is an introductory treatment of arbitrage pricing of derivative securities, covering binomial trees and convergence to Black-Scholes.

This course could be entitled "Basic things everyone working in finance needs to know". It starts with a discussion of interest, the term stucture of interest rates, and concepts relating to fixed-income securities. Elements of probability theory are reviewed, followed by mean-variance portfolio theory---the basic trade-off between risk and return described by Markowitz---and the Capital Asset Pricing Model (CAPM). We then discuss the representation of investor preferences in terms of expected utility, and move on to describe the relationship between linear pricing, arbitrage and portfolio choice. The final part of the course is an introductory treatment of arbitrage pricing of derivative securities, covering binomial trees and convergence to Black-Scholes.