MSc Mathematics & Finance (2014-2015): Elective Modules

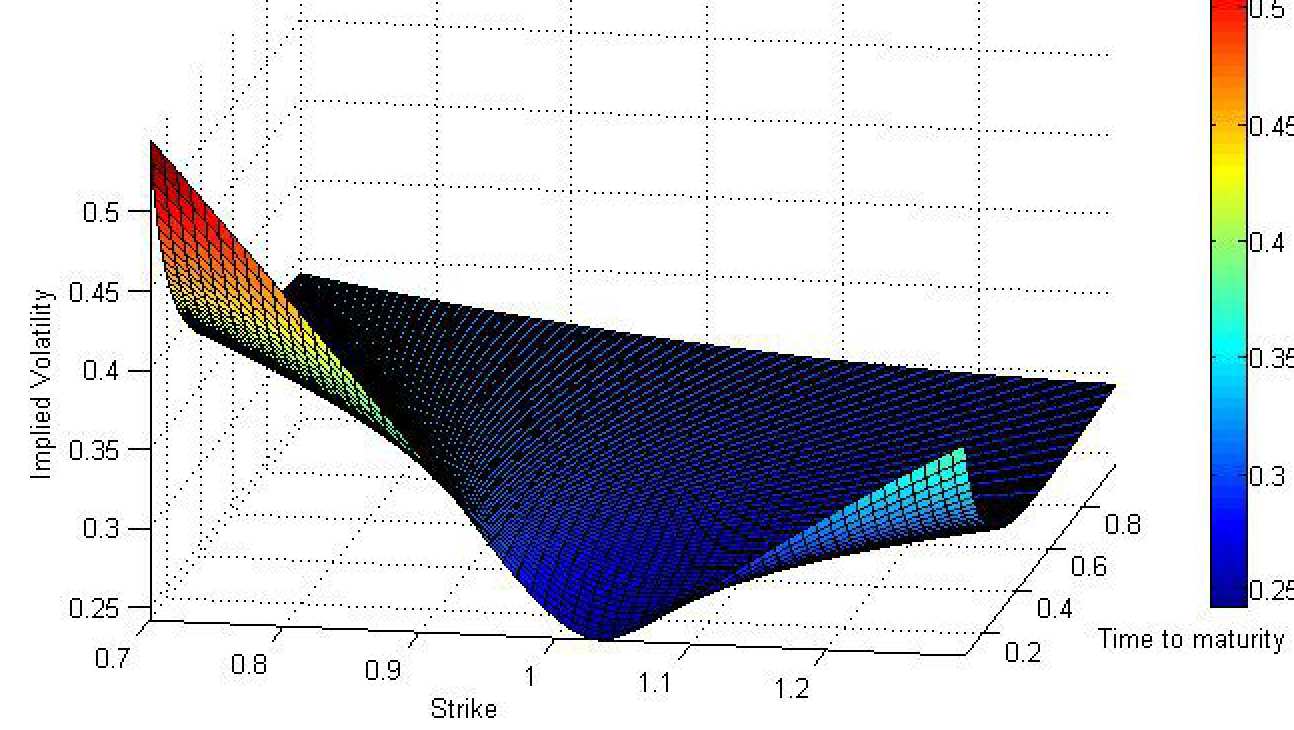

Advanced Topics in Volatility Modelling (A. Jacquier)

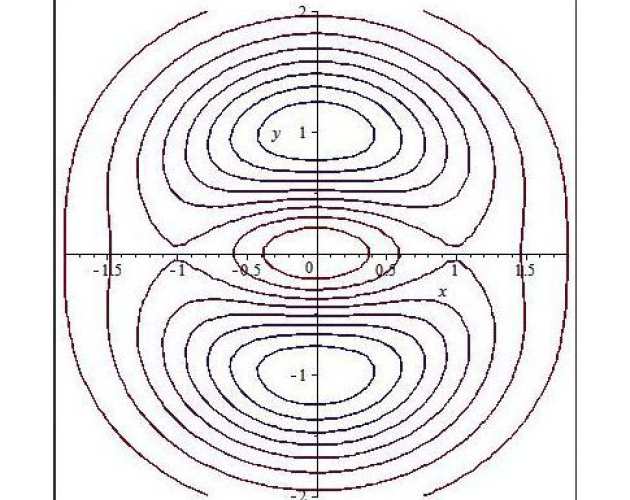

This course focuses on the characterisation and the properties of the different concepts of volatility in mathematical finance, namely implied, local, stochastic and historical volatilities. These will serve as the framework to answer the following questions: given a set of observed (European) option prices, (i) is there arbitrage opportunities and (ii) which model (with continuous paths) should one choose to model stock prices?

This course focuses on the characterisation and the properties of the different concepts of volatility in mathematical finance, namely implied, local, stochastic and historical volatilities. These will serve as the framework to answer the following questions: given a set of observed (European) option prices, (i) is there arbitrage opportunities and (ii) which model (with continuous paths) should one choose to model stock prices?

Algorithmic Trading and Machine Learning (G. Di Graziano and S. Ramaswamy)

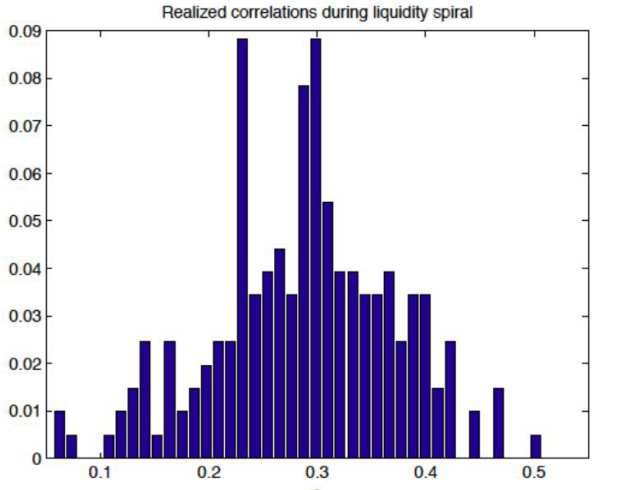

The aim of the course is to present a series of cutting-edge topics in the area of “Algorithmic trading” in a unified and systematic fashion. For each of the problems presented, we try to emphasize both the mathematical theory as well as industry applications. The course consists of two main parts: 1) Optimal Execution Problems and 2) Machine Learning in Finance. Optimal execution techniques are particularly relevant for market makers and quantitative brokers whereas machine learning is often used by hedge fund and prop desks to generate trading signals. However machine learning algorithms can be also applied as part of optimal execution tools, for example in order to chose order types or speed of execution. The basic optimal execution problem consists of an agent (e.g. a bank or a broker) who needs to buy or sell a pre-specified number of units of a given asset within a fixed time frame (e.g. an hour, a day, etc). Assuming that the purchase or sale of the asset will have an impact on its price, what is the execution policy which minimizes market impact? Having decided on the execution schedule, what type of order (market or limit order) is better to submit? The first problem can be formulated as a trade-off between the expected execution cost and the price risk due to exogenous factors. We shall solve the optimization problem for different types of

The aim of the course is to present a series of cutting-edge topics in the area of “Algorithmic trading” in a unified and systematic fashion. For each of the problems presented, we try to emphasize both the mathematical theory as well as industry applications. The course consists of two main parts: 1) Optimal Execution Problems and 2) Machine Learning in Finance. Optimal execution techniques are particularly relevant for market makers and quantitative brokers whereas machine learning is often used by hedge fund and prop desks to generate trading signals. However machine learning algorithms can be also applied as part of optimal execution tools, for example in order to chose order types or speed of execution. The basic optimal execution problem consists of an agent (e.g. a bank or a broker) who needs to buy or sell a pre-specified number of units of a given asset within a fixed time frame (e.g. an hour, a day, etc). Assuming that the purchase or sale of the asset will have an impact on its price, what is the execution policy which minimizes market impact? Having decided on the execution schedule, what type of order (market or limit order) is better to submit? The first problem can be formulated as a trade-off between the expected execution cost and the price risk due to exogenous factors. We shall solve the optimization problem for different types of

- Price dynamics (ABM vs GBM, with drift or without drift);

- Market impact type (temporary, transient, permanent);

- Exogenous Risk functions (variance, VaR).

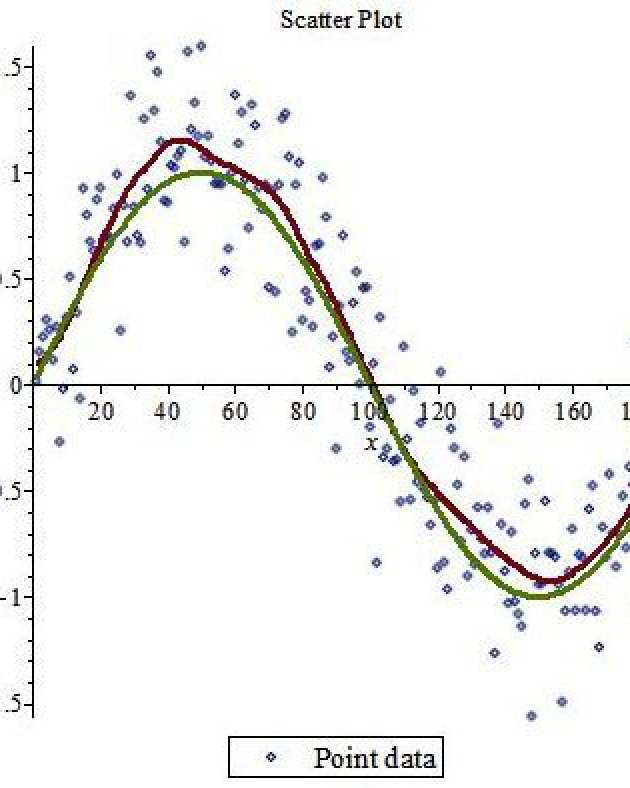

Machine learning techniques are becoming increasingly popular in the financial industry. They are typically used to help predict asset price patterns, volatility regimes, etc. The course starts by formalizing the concept of “learning” and providing an overview of various learning techniques. The subsequent lectures analyze in detail some of the most popular machine learning algorithms such as neutral networks and support vector machines. We then introduce various smoothing tools (kernel regression, wavelets, HHTs) which have historically been developed for signal processing applications but have found their way into finance over the last few years. Those methods can be used as stand alone or jointly with other learning algorithms, e.g. SVM. Finally, we shall analyze issues related to model selection and how to combine different models to improve the learning outcome. Trading applications using real market data will be presented during the course.

Dynamic Portfolio Theory (H. Zheng)

This is an introductory course on dynamic portfolio theory. The objective is to cover the basic mathematical methods for solving DPT problems. We will discuss Merton's optimal investment problem, utility maximization in complete and incomplete markets, stochastic control, dynamic programming principle, HJB equation, classical solution, verification theorem, viscosity solution, convex duality, martingale representation, dual stochastic control, Markov modulated model, etc. We will also discuss many applications, including utility indifference pricing, wealth maximization, optimal liquidation, turnpike property, mean-variance portfolio with constraints, quadratic hedging, etc.

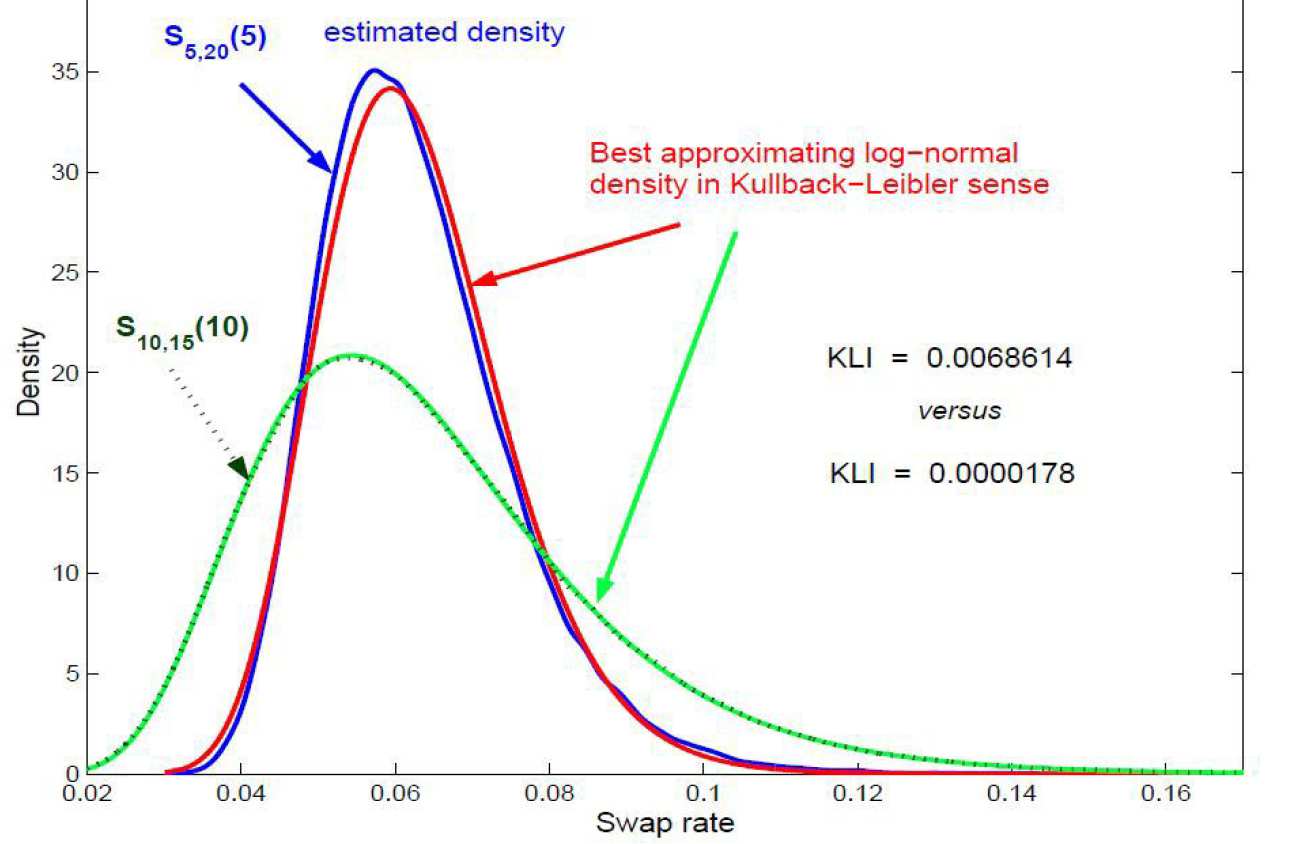

Fixed Income Markets (R. Martin)

This course is an introduction to fixed income markets and instruments. We will discuss how fixed income instruments are priced and traded. Particular emphasis will be given to the mechanics of trading the products, how to calculate P&L for a trade, how to understand the simpler aspects of trade ideas and "strategy pieces" put out by bank trading desks, and how to conceptualise risk and risk management.

Lévy Processes: Theory and Applications (M. Pistorius)

In this course we present an introduction to the theory of Levy processes, a fundamental class of continuous time stochastic processes, which includes the Poisson process, the Wiener process and the stable process and which is encountered in many financial modelling applications. We start by considering jump-diffusions and develop the corresponding stochastic calculus for this class of stochastic processes. By way of illustration, a number of financial applications are presented. We then move on to infinitely divisible distributions, the Levy-Khintchine formula, Levy-Ito decomposition and discuss the path-wise construction and simulation of paths of general Levy processes. When time permits we cover elements of fluctuation theory and Markov process theory.

In this course we present an introduction to the theory of Levy processes, a fundamental class of continuous time stochastic processes, which includes the Poisson process, the Wiener process and the stable process and which is encountered in many financial modelling applications. We start by considering jump-diffusions and develop the corresponding stochastic calculus for this class of stochastic processes. By way of illustration, a number of financial applications are presented. We then move on to infinitely divisible distributions, the Levy-Khintchine formula, Levy-Ito decomposition and discuss the path-wise construction and simulation of paths of general Levy processes. When time permits we cover elements of fluctuation theory and Markov process theory.

Numerical Methods for Finance (A. Jacquier)

In this course we will explore some of the main numerical tools anyone working in a quantitative field should know, namely finite difference methods for PDEs, numerical integration, optimisation methods and Fourier methods. We shall endeavour to strike a balance between the theoretical aspects of these tools and their practical implementations in mathematical finance.

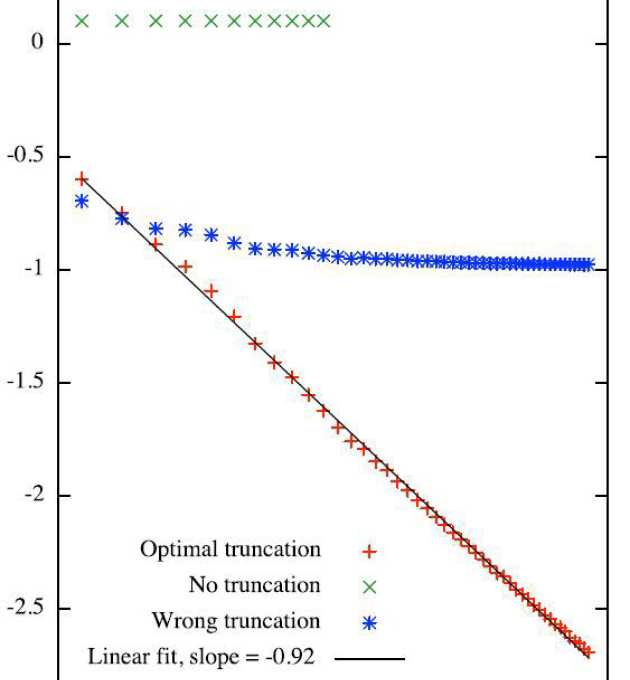

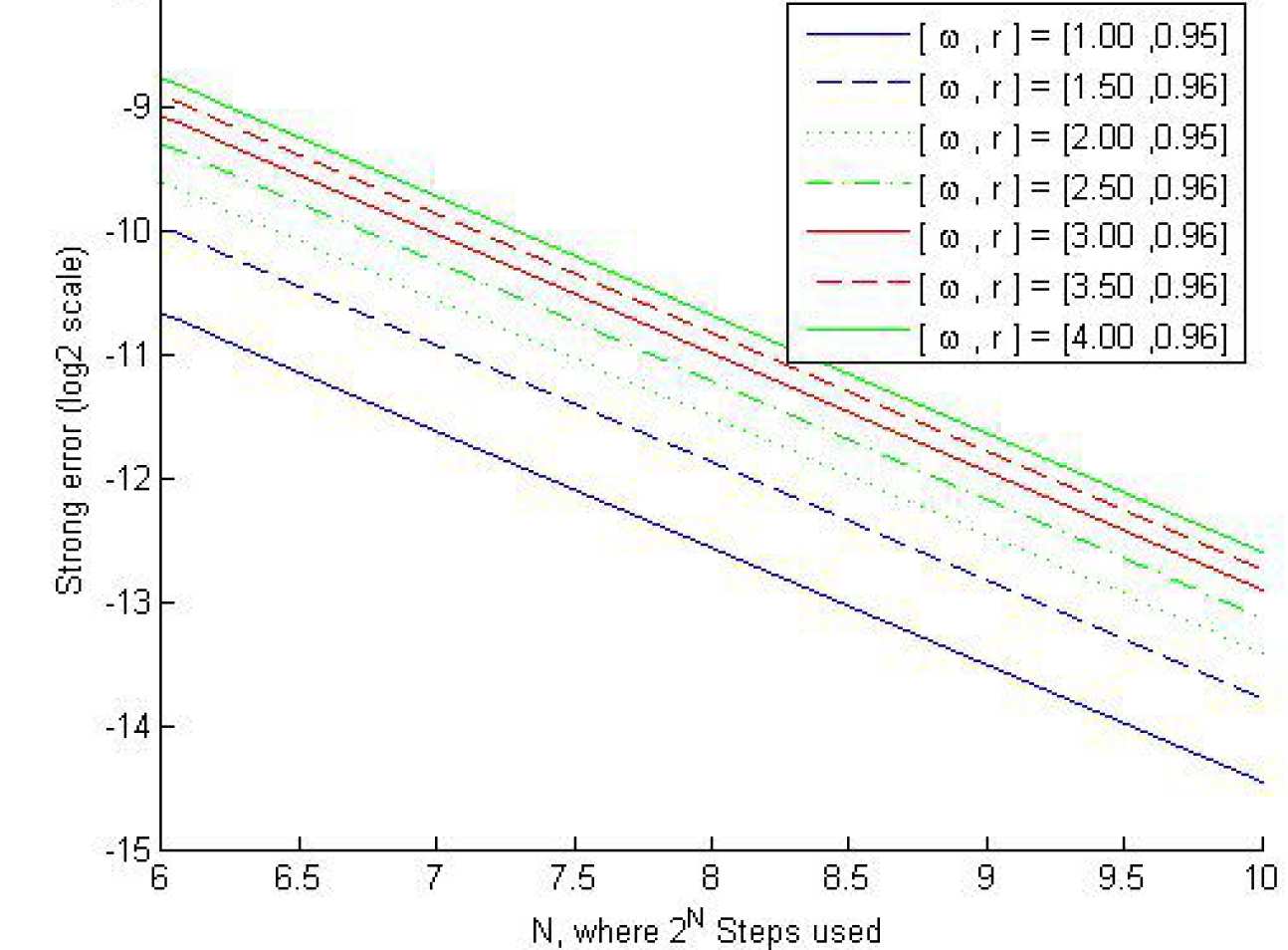

Simulation Methods for Finance (J.F. Chassagneux)

This course is an introduction to simulation methods in finance and more generally to probabilistic numerical methods for PDEs. It starts with discussion of random number generators, statistical tests and moves on to cover numerical schemes for solving Stochastic Differential Equations: the Euler, Milstein and certain higher-order schemes. Properties of weak and strong convergence, consistency and numerical stability are established. It then discusses variance reduction techniques and estimati on o f sensiti vities. The course will be concluded by studying a numerical method for American Options and non-linear PDEs, if time permits.

Statistical Methods in Finance (N. Bingham)

The course begins with a review of basic probability: topics include probability and conditional probability, random variables and distributions, some standard univariate distribut ions, and some notes on multivariate distributions. A corresponding review of the basic ideas underlying standard statistical methods is then give n: topics include samples and sampling distributions, estimation, hypothesis testing, and some asymptotic (large-sample) theory. Following these review sections are some more specialised topics: likelihood theory, statistical modelling and analysis, Bayesian approach and time series.

The course begins with a review of basic probability: topics include probability and conditional probability, random variables and distributions, some standard univariate distribut ions, and some notes on multivariate distributions. A corresponding review of the basic ideas underlying standard statistical methods is then give n: topics include samples and sampling distributions, estimation, hypothesis testing, and some asymptotic (large-sample) theory. Following these review sections are some more specialised topics: likelihood theory, statistical modelling and analysis, Bayesian approach and time series.

Stochastic Differential Equations (J.F. Chassagneux)

In this course, we will first present the main results concerning Stochastic Differential Equation (strong and weak existence, uniqueness, regularity). We will then introduce the class of Backward Stochastic Differential Equation. In a Markovian setting, we will discuss the link with nonlinear parabolic PDE proving a nonlinear Feynmann-Kac formula. We will motivate the course by different examples, some coming from mathematical finance. If time permits, we will discuss the basics of the numerical approximation of those equations.

In this course, we will first present the main results concerning Stochastic Differential Equation (strong and weak existence, uniqueness, regularity). We will then introduce the class of Backward Stochastic Differential Equation. In a Markovian setting, we will discuss the link with nonlinear parabolic PDE proving a nonlinear Feynmann-Kac formula. We will motivate the course by different examples, some coming from mathematical finance. If time permits, we will discuss the basics of the numerical approximation of those equations.