Businesses should embrace fintech to reduce global inequality say experts

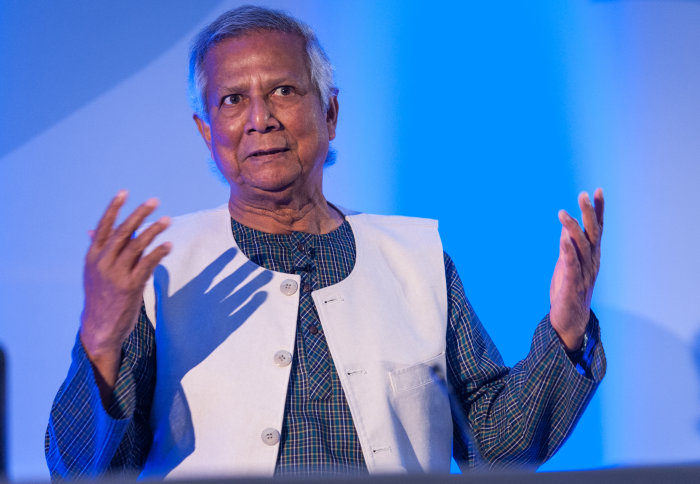

Professor Muhammad Yunus addresses delegates at The Future of Finance

Financial institutions should use technology to promote economic inclusion and development, said experts at the Business School yesterday.

The subject was discussed during the Future of Finance conference at Imperial College Business School, a leading authority on financial technology. The invite-only event, now in its third year, brought together an impressive array of business heads, policy planners and senior finance academics from the Business School.

Lloyds Banking Group CEO Antonio Horta Osorio said there were “few better venues” to discuss the future of finance. He pointed out that we were living in a time of unprecedented change, including the way technology is dramatically transforming the ways in which banks seek to meet the evolving financial needs of individuals and businesses alike. “But at the same time, the bank of the future needs to be inclusive … it must always look after the interests of the vulnerable”, he said. “It is therefore encouraging, if perhaps counter-intuitive, that the digital transformation is creating more, not fewer, opportunities for vulnerable customers”.

Technology as a force for good

A panel on inequality and development further concluded that technology can curb economic stagnation in developing nations. Ralph De Haas, Director of Research at the European Bank for Reconstruction and Development, discussed the impact of mobile money in sub-Saharan Africa. He said: “Mobile technology has broader impact than initially thought. We know it’s being used to facilitate payments, trade and saving. But mobile money is becoming almost an insurance mechanism. If there is a catastrophe, you can receive money from a wider range of sources than in the past.”

Mr De Haas said he believed that improved access to finance could have a positive impact on developing economies. He said: “People become less sensitive to economic shocks and they switch out of traditional labour into self-employment. That is a positive, as people have more ownership over their economic lives.”

Pursuing social and shareholder value

The need for financial inclusion in the developing world, was a prominent theme throughout the conference. Muhammad Yunus, a Nobel Laureate who founded the 600-branch Grameen Bank in Bangladesh, pondered the challenges poor people face accessing finance due to bad credit scores. In sub Saharan Africa, two-thirds of people do not have access to a bank account.

Professor Yunus spoke of the need for financial institutions to pursue social objectives as well as shareholder value, to improve access to credit and catalyse entrepreneurship. He said: “Credit should be accepted as a human right…If you connect people with finance they become alive and productive.”

"Our conference was a unique opportunity to learn, reflect and reimagine a fundamental area of business and society, while showcasing Imperial’s intellectual leadership.” Professor Francisco Veloso Dean of Imperial College Business School

Cryptocurrency craze

The need for financial institutions to harness technology such as cryptocurrencies was another highlight of the event. Thomas F Huertas, Partner and Chair of the EY Global Regulatory Network, summarised the “disruptive” financial environment. He said: “Advances in technology are making data more readily available as well as cheaper to store and process. That has profound implications for finance. It lowers the cost of providing financial services while potentially improving quality and reducing risk.”

But Mr Huertas said there was also a dark side to new technology. “It disseminates the spread of disinformation and can increase the potential for market abuse. It also greatly increases the threat of cyber-crime.”

The event was co-chaired by Professor Franklin Allen, Executive Director of the Brevan Howard Centre for Financial Analysis and Professor Andrea Buraschi, Chair of Finance at the Business School.

In concluding remarks Professor Francisco Veloso, Dean of Imperial College Business School said: “I was impressed by the wide range of financial leaders present and the thought-provoking discussion led by Imperial academics. From cryptocurrencies and social business to digital transformation and regulation, the financial industry is undergoing fundamental change. Our conference was a unique opportunity to learn, reflect and reimagine a fundamental area of business and society, while showcasing Imperial’s intellectual leadership.”

This article was written by Seb Murray.

Article text (excluding photos or graphics) © Imperial College London.

Photos and graphics subject to third party copyright used with permission or © Imperial College London.

Reporter

Laura Singleton

Communications Division