Useful tips

- If you have a choice, you may prefer a monthly payment scheme so you do not receive large quarterly bills

- Arrange an area where bills and correspondence can be left for each other to see

- Keep records of all letters and correspondence that you have had with suppliers. When a bill comes in, pay your agreed share immediately

- Open a joint bank account for bills only, and each set up a standing order

- Start a money pot for household essentials, e.g. loo roll, washing powder

Bills

All residents are jointly responsible for paying utility bills. Some landlords insist that you do not switch utility companies. Please check before doing so and be aware of utility companies who try to persuade you to switch bills.

Make a note of your meter readings on the day you move in and inform the supplier as soon as you can to avoid paying for the previous tenant’s bills.

Consider the following:

- Will you all pay the utility companies individually or will bills be split evenly?

- How will you let each other know when the bill arrives and who needs to pay what?

Bills to set up

- Gas

- Electricity

- Water

- Internet

- TV Licence

TV Licence

If you watch live TV, catch up service or streaming, you will need a TV licence. How you will pay for your licence will depend on the type of tenancy agreement you have.

The current licence fee is £159 per annum, and if you are caught without a TV Licence you could face prosecution and a fine of up to £1,000.

If you are away during the summer period you may be eligible for a refund. For more information visit the TV licence website.

Council tax

Council tax

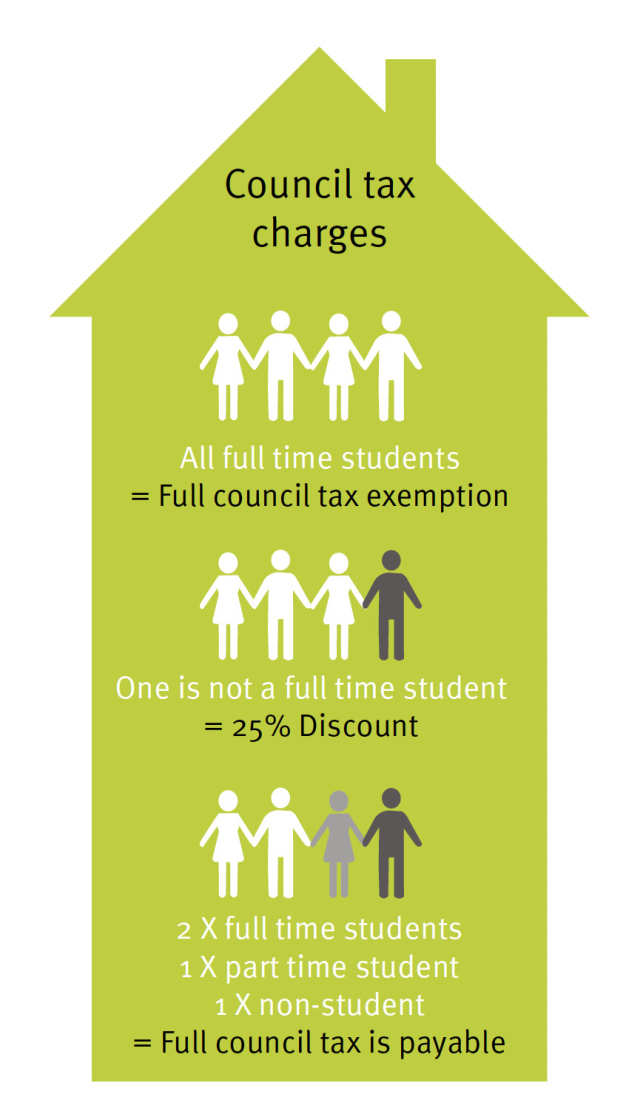

If you and your housemates are all full-time students then you are exempt from paying council tax. You and your housemates will each need to submit a council tax exemption letter or proof of enrolment, along with a copy of your tenancy agreement to your local authority. This is usually done online. Be sure to keep a copy for yourself.

If you live with someone who is in full-time employment and not studying, then council tax will be imposed on the property. You may be asked to pay a percentage of the cost.

You are responsible for proving you are exempt from paying council tax.