Tables

- Table 1: Student startups* formed 2017-18

- Table 2: IP startups* formed 2017-18

- Table 3: Progress of Imperial startups 2017-18

- Table 4: Notable investment rounds for Imperial startups 2017-18*

- Table 5: Notable student startup successes 2017-18

- Table 6: Notable market activity for IP startups 2017-18

- Table 7: Startups in the White City Incubator as of July 2018

| Startup | Concept |

|---|---|

| Basic materials | |

| Finite | A material developed from desert sand with similar structural properties to concrete but less than half the carbon footprint. |

| Tagless | A protective anti-graffiti coating that can be applied to a range of surfaces. It also protects vulnerable buildings from weathering erosion. |

| Consumer | |

| Emit | A time-management tool that shows people the amount of time left before their next commitment rather than time as an absolute value. |

| Knightsbridge Tutors | A range of tuition services to make learning fun and productive for school children. |

| Education | |

| Bawer Services | Educational, engagement and research services, with expertise in diversity and inclusion. |

| Energy | |

| Progress Energy Consulting | Management consulting services for the energy industry. |

| Financial services | |

| ApTap | This app connects users with their banks and service providers to retrieve bills and manage payments and services with a single tap. |

| OsusuMobile | Helps the unbanked and the underbanked save money by making deposits with an SMS-enabled mobile phone. |

| Quanterium Technologies | Developing a fully regulated digital asset trading platform, incorporating elements of blockchain technology. |

| Track | An AI-driven tool to help homebuyers make complicated financial decisions more easily and transparently. |

| Food & nutrition | |

| BioKind | Ferments agricultural waste to produce sustainable and traceable protein feed for aquaculture, livestock and pets. |

| Higher Steaks | Uses cell culture techniques to produce lab-grown meat quickly and affordably using a scalable process. |

| Mela | A service company that provides chocolate bonbons with a bacterial cocktail specially designed to improve your wellbeing. |

| Nutribloc | A plant protein-based block of powder that dissolves in a liquid to create a healthy drink or boost a smoothie. |

| Industrials | |

| Matoha Ultrascience | A scanner to identify accurately and rapidly what polymer a piece of plastic is made from, so it can be sorted for further processing. |

| Medical devices | |

| Gilaasi | Working on a patent-pending innovation that enables users to switch from glasses to sunglasses with just a tap of the frame. |

| Microsonix | Working to bring life-saving medical imaging to more people in developing countries with a miniature, low-cost ultrasound imaging device that connects to a smartphone. |

| Mitt | An accessible, comfortable, plug-and-play prosthesis to help people suffering from limb loss. |

| Momoby | An innovative finger prick test to bring antenatal care to women living in geographically isolated areas. |

| Motus Innovations | A new generation of low cost robotic rehabilitation devices to make rehabilitation technologies more accessible to those who need them most. |

| Neuroloom | High resolution brain-machine interfaces, with their first application in restoring sight for people with conditions such as macular degeneration. |

| QuickCount | A low-cost, hand-held device for point-of-care blood analysis. |

| Pharma & biotech | |

| Naturacorp | Genetically engineered, dirt-eating bacteria to reduce the use of carcinogens in the dry cleaning industry. |

| Vigor | A glove that provides extra strength to children with muscular dystrophy, mild cerebral palsy or related neuromuscular diseases. |

| Technology | |

| BlakBear | Innovative sensor technologies for measuring air quality, and applications for food packaging and agriculture. |

| BlockClaim | Combining AI and blockchain to improve detection of fraudulent claims and reduce claims processing time in the motor insurance sector. |

| Boetho | A machine learning-based algorithm to predict demand for and optimise occupancy of parking spaces. |

| Deep Render | Machine learning and computer vision algorithms with applications for compression and rendering systems. |

| Donaco | Facilitates online donations by using AI to place calls for donations from readers next to relevant online articles. |

| Drip | A cobot to dispense shots and basic mixers in nightclubs by pouring eight drinks per minute. |

| Dyne London | This app increases table turnover for exclusive restaurants by offering users the chance to occupy cancelled/no-show tables within 20 minutes. |

| Elemental | Based on the game mechanics of Pokemon to build an educational game for students to learn about chemistry. |

| InAGlobe Education | Connects problems identified by NGOs in developing countries with students in technical universities who work on solutions as part of their degree. |

| Lekta Therapy | An online therapy platform for improving mental health. |

| Loop Party | A social event organisation app for people to plan meetups, covering everything from invites to cost-splitting, music and clean-up. |

| NeuroCreate | A personal interactive, AI-powered platform with a suite of digital tools to help people become more efficient and productive. |

| Pepar | This app suggests recipes based on available ingredients from users nearby, encouraging the creative and social use of high-risk food. |

| Phenomic AI | Deep learning solutions to accelerate drug discovery. |

| Telecoms | |

| Meetual | A mobile application that lets users connect their friends with each other. |

| Travel & leisure | |

| Balentify Events | Conference, exhibition, fair and event services in London. |

| For the Love of the Game | Identifies opportunities to play sports in competitive, social leagues across London. |

| * Companies founded to exploit IP or discoveries made by Imperial students during their degree courses. | |

| Startup | Concept |

|---|---|

| Basic materials | |

| Exactmer | A new technology platform – Nanostar Sieving – to produce high molecular weight polymers of outstanding purity. |

| Energy | |

| RFC Power | New technologies for mitigating issues linked to the cost and limited availability of the raw materials needed for batteries. RFC Power’s unique technology combines optimised cell architecture and low-cost chemistry in a hybrid gas-liquid redox flow battery. |

| Industrials | |

| Tribosim | A tribology simulation and consultancy business. |

| Medical devices | |

| Accunea | Medical device and novel point-of-care diagnostic to provide real-time monitoring of kidney function. |

| CEEK Health | Ear examination kit. |

| Precision Robotics | Medical robots have been developed to conduct colorectal oncology surgeries. The platform will be expandable for other surgeries including oral and gynaecological. |

| VODCA | Early cancer detection by breath testing. |

| Pharma & biotech | |

| Cagen | Cagen has developed self-assembling protein nanocages that can be used to transport and deliver drugs within the body, protecting them from premature degradation. |

| Technology | |

| FaceSoft | Proprietary machine learning models and databases to improve computer-generated 3D face reconstruction and facial recognition. |

| GraphicsFuzz | Specialise in mobile graphics benchmarking tools, including the detection of vulnerabilities in graphics drivers, enabling clients to quickly find and fix bugs that could undermine reliability and security before they affect end users. |

| * Companies founded to exploit IP owned by Imperial, typically led by academic staff who made the initial discovery. Based on licence of College IP into the company. | |

| Criteria | IP startups | Student startups | Total |

|---|---|---|---|

| Number of active startups (as of 31 July 2018) | 79 | 122 | 201 |

| Number of listed startups (as of 31 July 2018) | 5 | 0 | 5 |

| Number of startups acquired by third parties (since 2000) | 24 | 6 | 30 |

| Investment funds secured in 2017-18 (£m) | 87.5 | 17.6 | 105.1 |

| Startup | Amount raised (£m) | Context |

|---|---|---|

| Basic materials | ||

| Biomin | 0.4 | Raised via an internal round |

| Microtech Ceramics | 1.25 | Develops novel ceramic substrates for the automotive emissions control market, closed a £1.25m investment deal. |

| Energy | ||

| Bramble Energy | 0.6 | Bramble Energy is an Imperial / University College London startup that has developed a unique, patent-protected, printed circuit board fuel cell. This utilises cost-effective production methods and materials to reduce the cost and complexity of manufacturing of proton exchange membrane fuel cells. It has recently raised £600,000 from three investors. |

| Technology | ||

| FaceSoft | 0.46 | FaceSoft uses machine learning models for 3D face reconstruction and facial recognition. The team has trained its face reconstruction algorithm parameters using a proprietary database of 2.5 million high-resolution 3D scans of real faces. The trained reconstruction model enables FaceSoft to create billions of realistic computer-generated faces, far surpassing any existing database of real faces. It completed a £150,000 Seed Enterprise Investment Scheme investment. |

| * Based on publicly announced information | ||

| Startup | Prize / award | Context |

|---|---|---|

| Food & nutrition | ||

| Skipping Rocks Lab | Undisclosed | Sky Ocean Ventures invested in Skipping Rocks Lab's edible sachet Ooho. |

| Industrials | ||

| Customem | £1.2 million | Secured Horizon 2020 funding to brings its innovative water filtration system to market. |

| Medical devices | ||

| Gyrogear | £1.6 million | Secured Horizon 2020 SME instrument funding, to support development of its stabilising GyroGlove for patients with hand tremors. |

| Neuroloom | £100,000 | Won the 2018 Panacea Stars Accelerators award. |

| Personal care | ||

| Polipop (formerly WithLula) | £20,000 | Won The 2018 London Mayor’s Entrepreneur Competition. |

| Technology | ||

| Gravity Sketch | £1.2 million | Raised from Forward Partners (London) and Super Ventures (San Francisco). |

| Phenomic AI | £1.2 million | Raised from Forward Partners (London) and Super Ventures (San Francisco). |

| Quit Genius | £1.5 million | Won a 2018 Pitch@Palace People’s Choice award. Finished Y Combinator and raised £1.5 million seed round from angel investors. |

| Startup | Context |

|---|---|

| Energy | |

| Nexeon | Nexeon develops silicon materials for next generation Li-ion batteries. In early 2018 it was awarded £7 million in Innovate UK funding to develop significantly better materials for Li-ion batteries. |

| Food & nutrition | |

| Skipping Rocks Lab | Ooho! - the edible, biodegradable packaging developed by Skipping Rocks Lab - is now being used by Selfridges as part of the department store’s work to eliminate single-use plastic bottles from its shelves and reduce overall plastic pollution. The Skipping Rocks Lab team also received investment from Sky Ocean Ventures. |

| Medical devices | |

| EMcision | EMcision – the company that developed the Habib™ EndoHPB probe - was acquired by global medical technology leader Boston Scientific. The probe is used by physicians in the treatment and palliative care of patients living with pancreaticobiliary cancers, which account for nearly a million deaths each year and have limited treatment options. |

| Technology | |

| GraphicsFuzz | GraphicsFuzz specializes in mobile graphics benchmarking tools. In August 2018 it was acquired by Google |

| Startup | Context |

|---|---|

| Basic Materials | |

| Polymateria | Biodegradable, recyclable, customizable and cost-effective plastics. |

| Energy | |

| SMAP Energy | Smart energy meter data to accelerate the adoption of Energy AI. |

| SweetGen | Creating energy from waste water with innovative catalyst technology. |

| Industrials | |

| Customem | Targeted filtering technology for micropollutants. |

| HackScience (now Cytera) | Harnessing the internet of things and web technologies to accelerate scientific research by enabling scientists to create and share affordable lab tools to automate manual processes. |

| Hexxcell* | Thermo-hydraulic fouling predictions for heat exchangers. |

| Medical devices | |

| MediSieve | Drug-free malaria treatment using magnetic blood filtration. |

| Smart Respiratory | Smart peak flow meter and app for helping asthma patients track their lung function. |

| Pharma & biotech | |

| Affinity Laboratories | Diagnostics and therapeutics through biomarker discovery. |

| Autolus Ltd | Developing novel immunotherapies for oncology. |

| Axitan | Veterinary vaccines and peptides from microalgae. |

| FreshCheck | Quick confirmation of bacterial contamination. |

| GammaDelta Therapeutics | Harnessing gamma delta T cells to improve immunotherapy for diseases including cancer. |

| MiNA Therapeutics | Gene activation mechanisms through small activating RNA. |

| Pulmocide* | Inhaled anti-infectives for targeted treatment of life-threatening lung infections. |

| Senzer | Inhaled anti-infectives for targeted treatment of life-threatening lung infections. |

| ThinAir | Bringing water to water-scarce communities across the globe. |

| Technology | |

| SIME DX (SIME Diagnostics) | Realising the potential of photonics and machine learning in clinical diagnostics. |

| Therapeutic Frontiers* | Human rhinovirus experimental infection model for studies in human asthma and chronic obstructive pulmonary disease. |

| * indicates an affiliation with Imperial through IP |

Figures

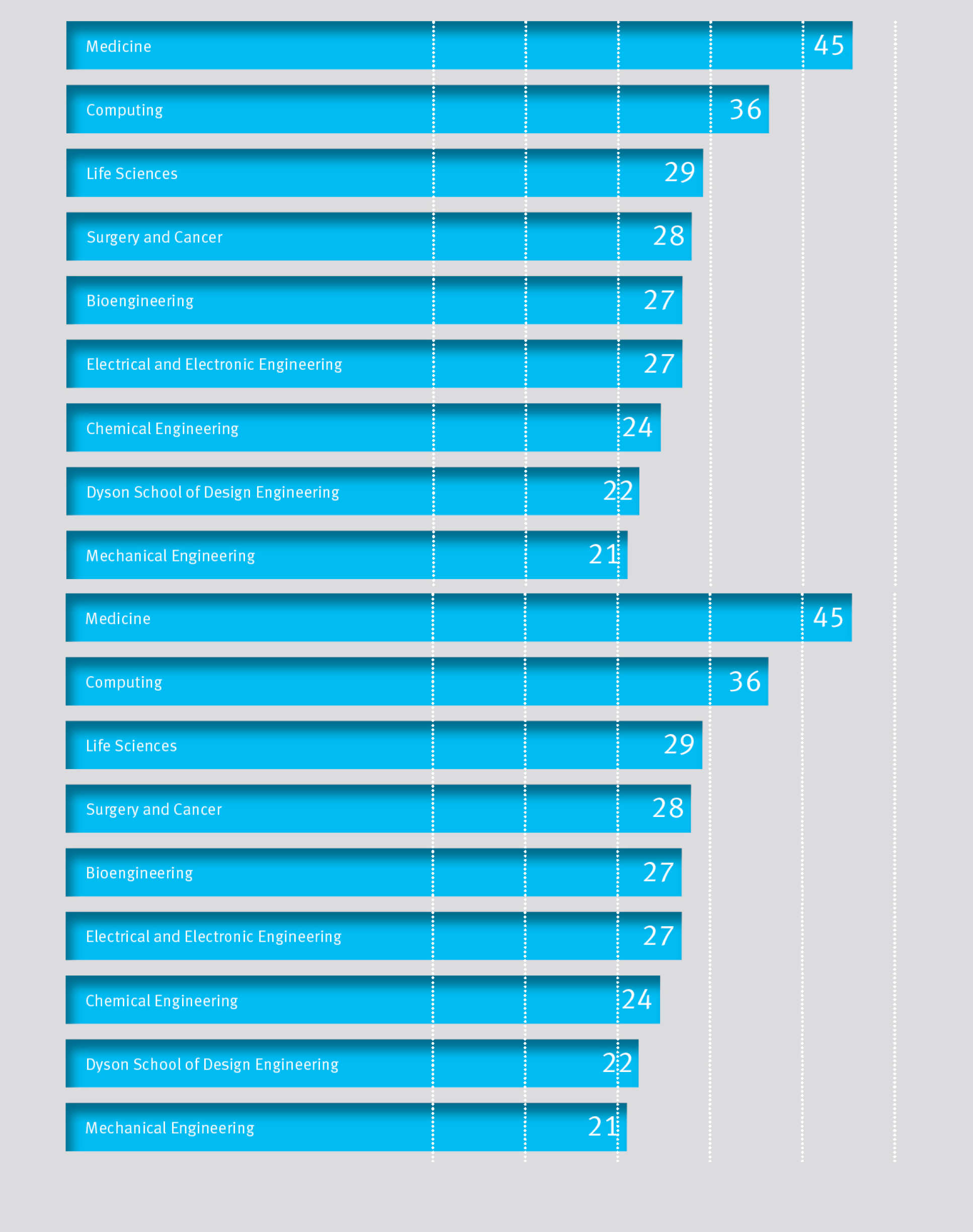

- Distribution of invention disclosures by academic department at Imperial 2017-18

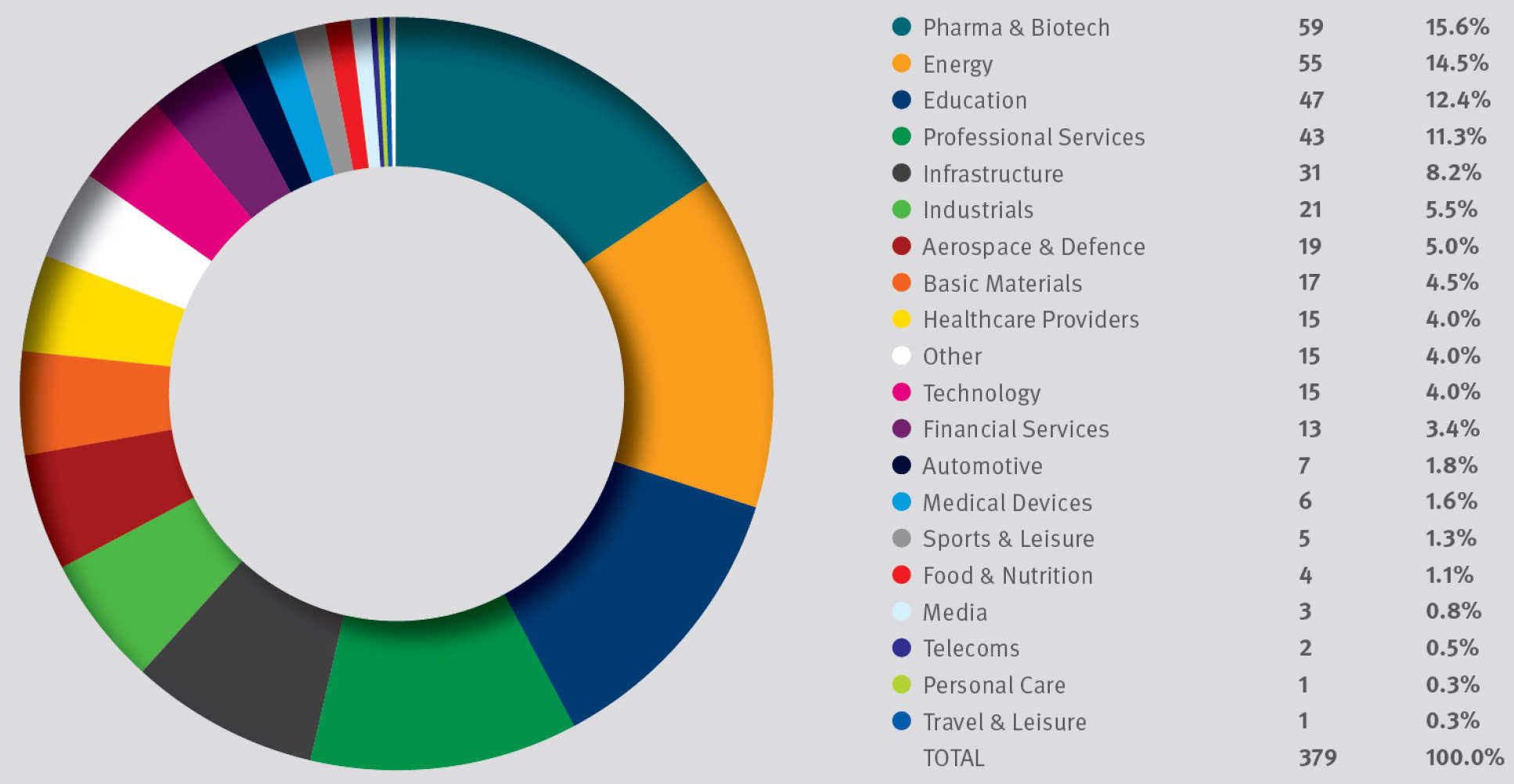

- Imperial Consultants projects by sector 2017-18

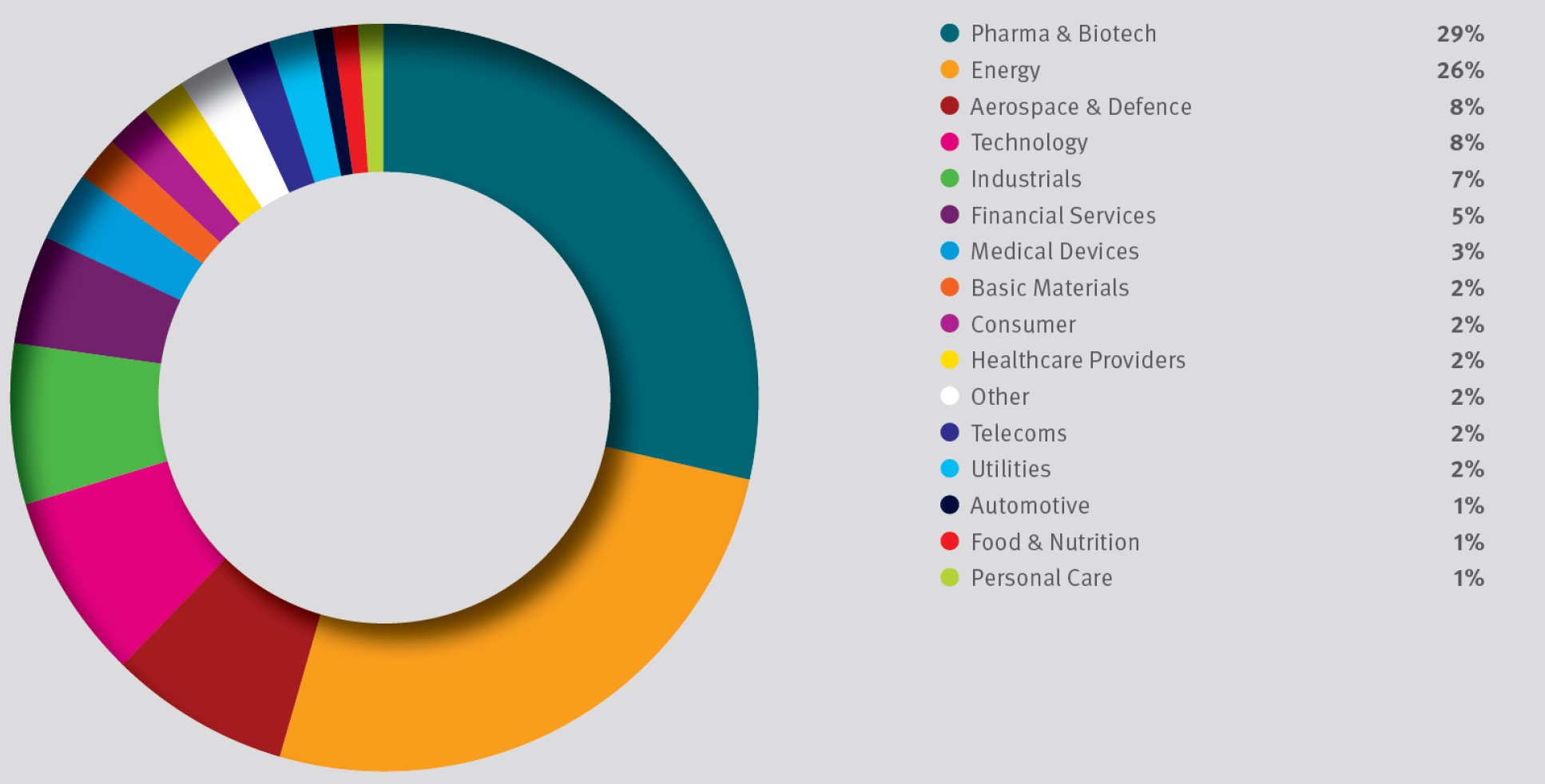

- Industry income in 2017-28 by sector

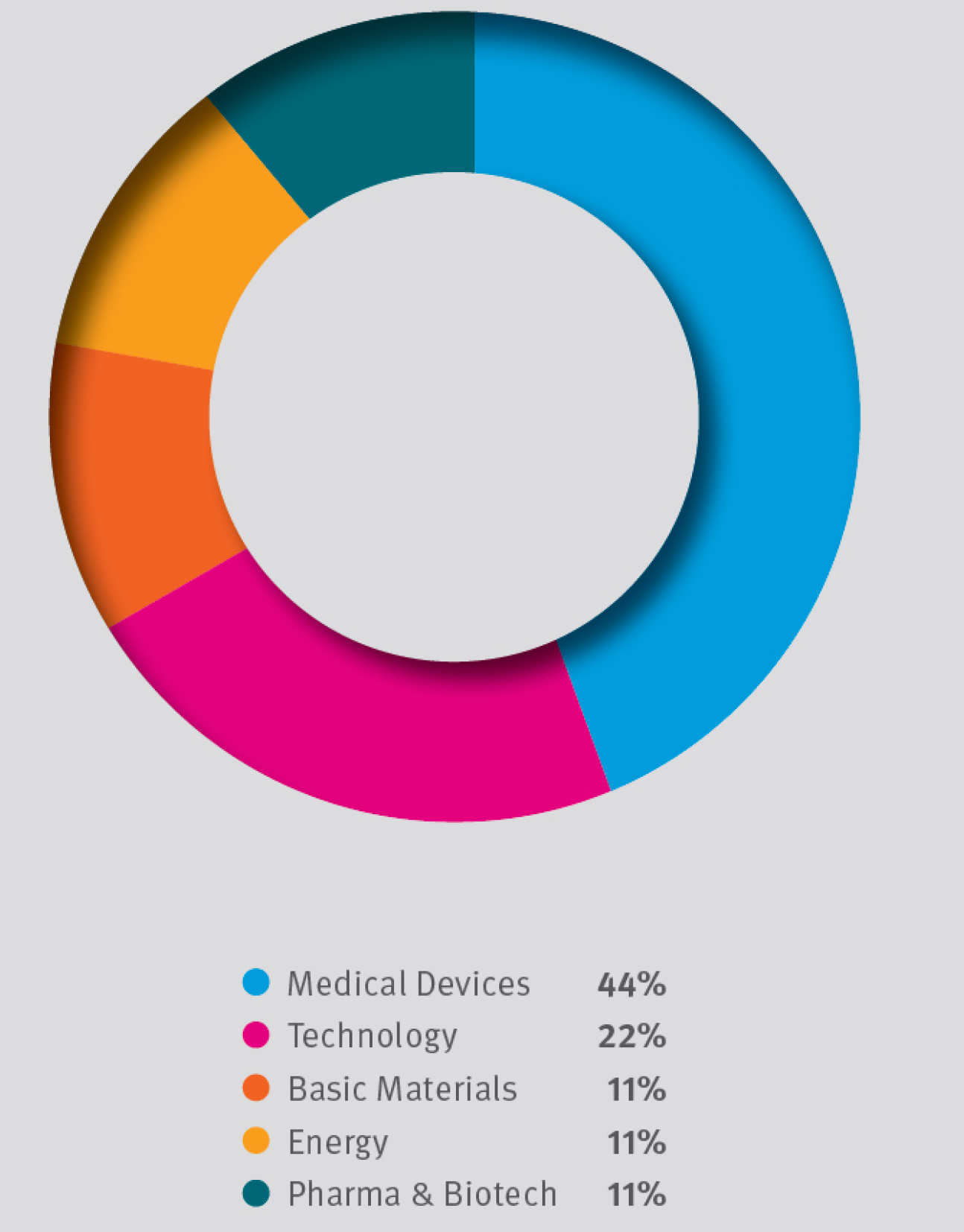

- IP startups formed in 2017-18 by sector

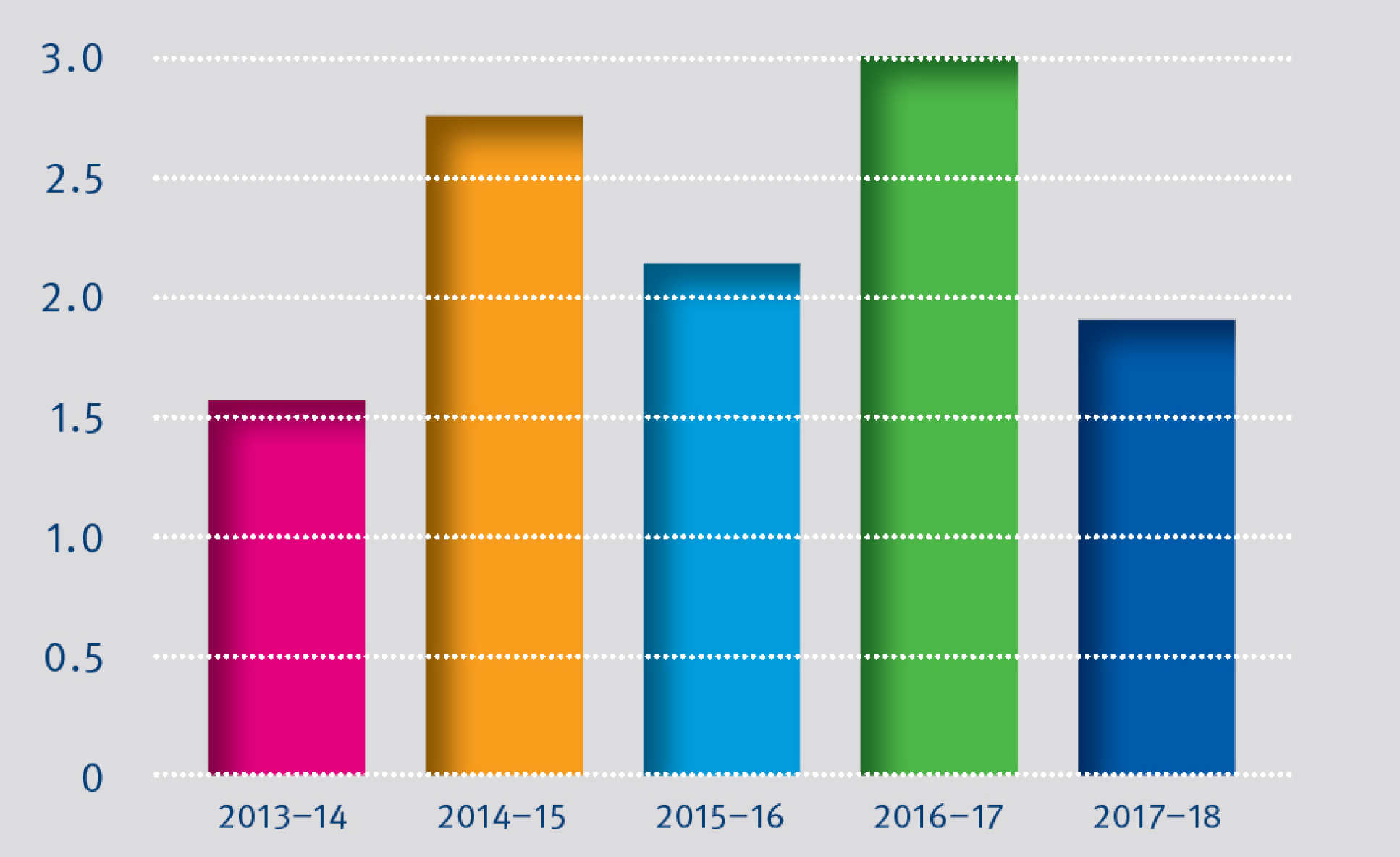

- Licensing revenue (£m) at Imperial College London 2013-18

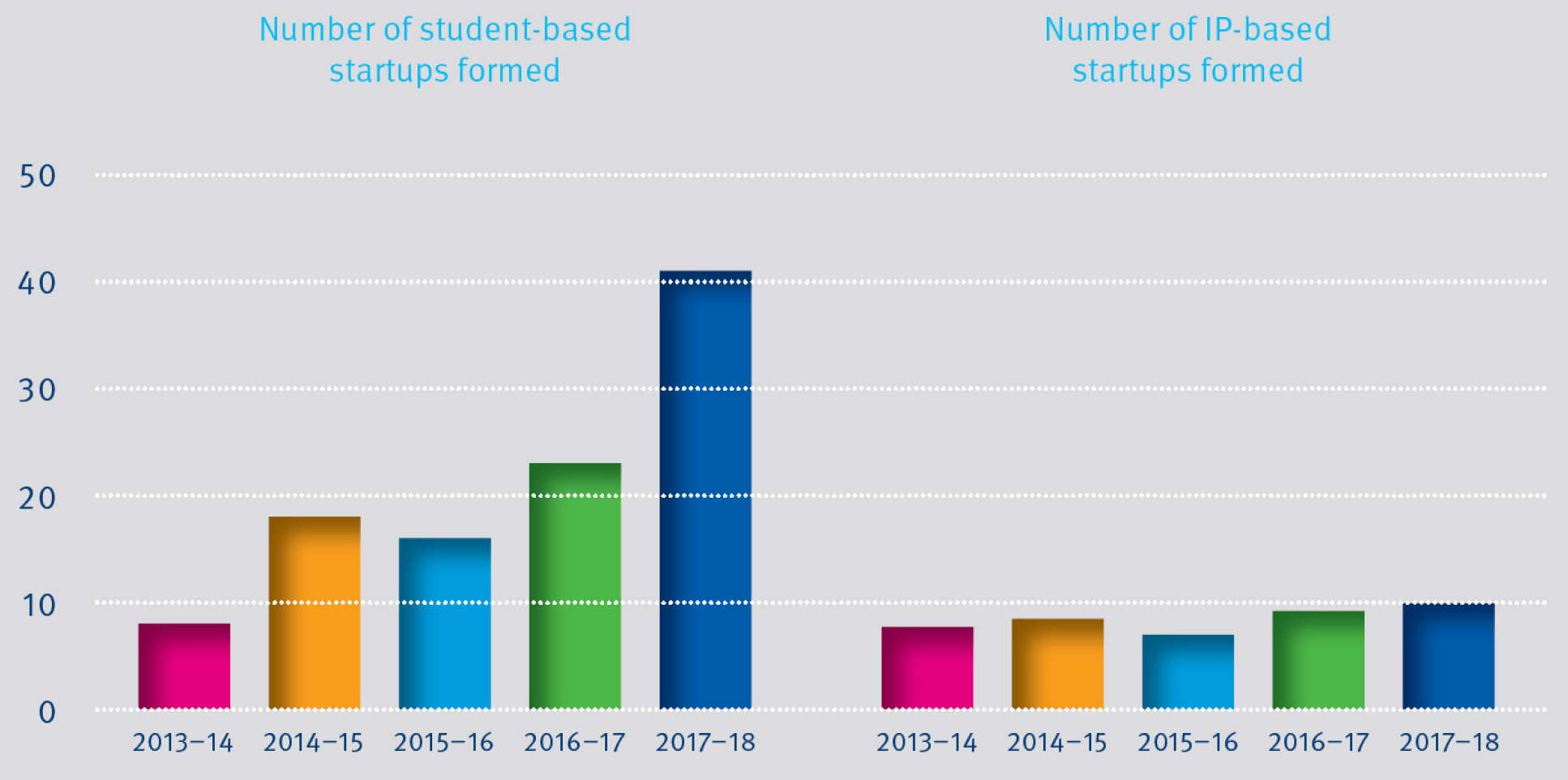

- Number of IP and student startups formed at Imperial 2013-18

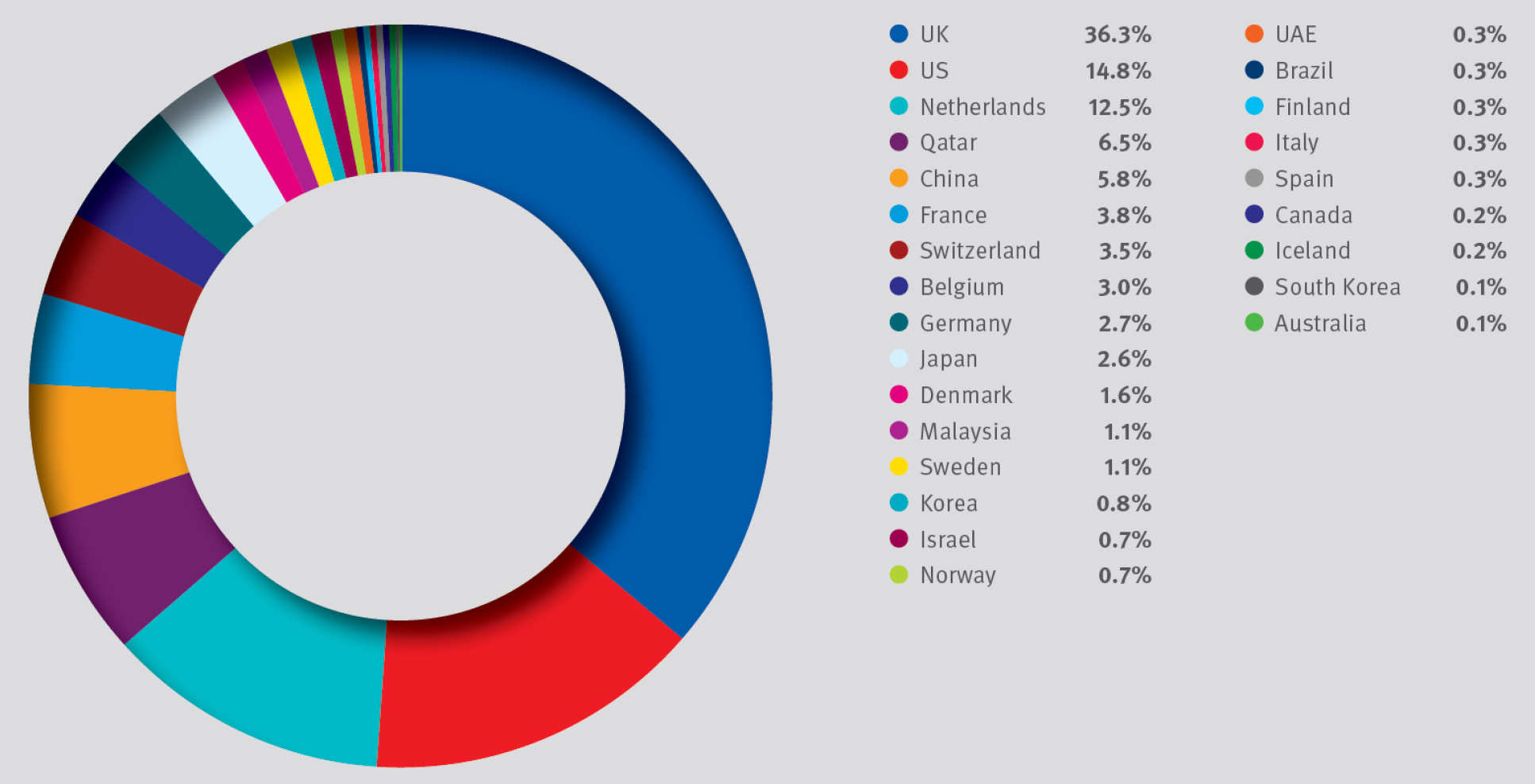

- Research income from industry by country of headquarter

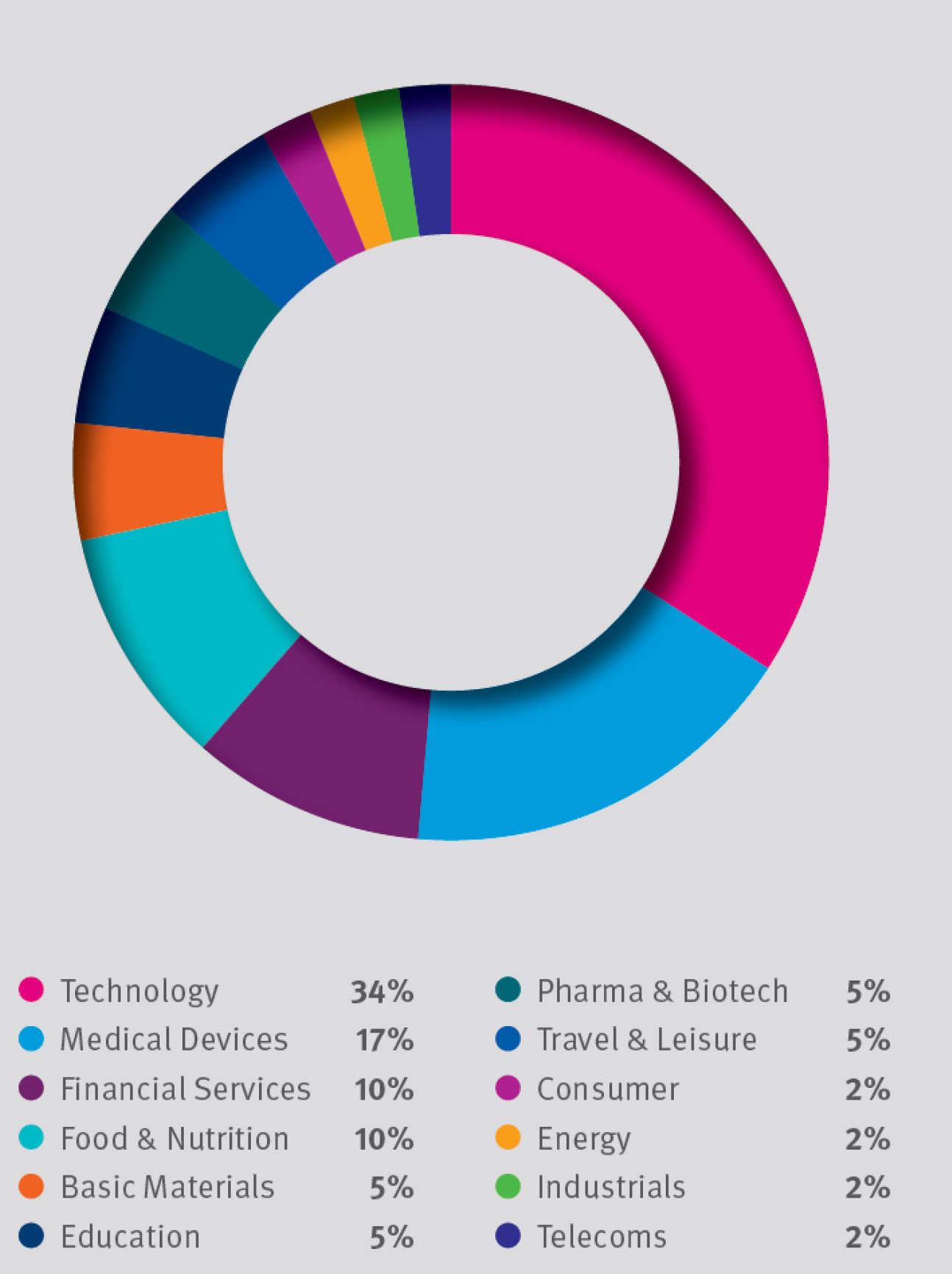

- Student startups formed in 2017-18 by sector

Medicine - 45

Medicine - 45

Computing - 36

Life Sciences - 29

Surgery and Cancer - 28

Bioengineering - 27

Chemical Engineering - 24

Dyson School of Design Engineering - 22

Mechanical Engineering - 21

Materials - 21

Chemistry - 18

Physics - 15

Aeronautics - 12

Civil and Environmental Engineering - 12

National Heart and Lung Institute - 10

Mathematics - 7

London Institute of Medical Sciences - 7

Eart Science and Engineering - 6

Business School - 5

School of Public Health - 2

Pharma & Biotech: 59 (15.6%), Energy: 55 (14.5%), Education: 47 (12.4%), Professional Services: 43 (11.3%), Infrastructure: 31 (8.2%), Industrials: 21 (5.5%), Aerospace & Defence: 19 (5%), Basic Materials: 17 (4.5%), Healthcare Providers: 15 (4%), Other: 15 (4%), Technology: 15 (4%), Financial Services: 13 (3.4%), Automotive: 7 (1.8%), Medical Devices: 6 (1.6%), Sports & Leisure: 5 (1.3%), Food & Nutrition: 4 (1.1%), Media: 3 (0.8%), Telecoms: 2 (0.5%), Personal Care: 1 (0.3%), Travel & Leisure: 1 (0.3%), Total: 379

Pharma & Biotech: 59 (15.6%), Energy: 55 (14.5%), Education: 47 (12.4%), Professional Services: 43 (11.3%), Infrastructure: 31 (8.2%), Industrials: 21 (5.5%), Aerospace & Defence: 19 (5%), Basic Materials: 17 (4.5%), Healthcare Providers: 15 (4%), Other: 15 (4%), Technology: 15 (4%), Financial Services: 13 (3.4%), Automotive: 7 (1.8%), Medical Devices: 6 (1.6%), Sports & Leisure: 5 (1.3%), Food & Nutrition: 4 (1.1%), Media: 3 (0.8%), Telecoms: 2 (0.5%), Personal Care: 1 (0.3%), Travel & Leisure: 1 (0.3%), Total: 379

Pharma & Biotech: 29%, Energy: 26%, Aerospace & Defence: 8%, Technology: 8%, Industrials: 7%, Financial Services: 5%, Medical Devices: 3%, Basic Materials: 2%, Consumer: 2%, Healthcare Providers: 2%, Other: 2%, Telecoms: 2%, Utilities: 2%, Automotive: 1%, Food & Nutrition: 1%, Personal Care: 1%

Pharma & Biotech: 29%, Energy: 26%, Aerospace & Defence: 8%, Technology: 8%, Industrials: 7%, Financial Services: 5%, Medical Devices: 3%, Basic Materials: 2%, Consumer: 2%, Healthcare Providers: 2%, Other: 2%, Telecoms: 2%, Utilities: 2%, Automotive: 1%, Food & Nutrition: 1%, Personal Care: 1%

Medical devices: 44%, Technology: 22%, Basic Materials: 11%, Energy: 11%, Pharma & Biotech: 11%

2013-14: 1.6, 2014-15: 2.6, 2015-16: 2.1, 2016-17: 3.0; 2017-18: 1.9

2013-14: 1.6, 2014-15: 2.6, 2015-16: 2.1, 2016-17: 3.0; 2017-18: 1.9

Student startups - 2013-14: 8, 2014-15: 18, 2015-16: 16, 2016-17: 23, 2017-18: 41. IP startups - 2013-14: 7, 2014-15: 8, 2015-16: 6, 2016-17: 9, 2017-18: 10

Student startups - 2013-14: 8, 2014-15: 18, 2015-16: 16, 2016-17: 23, 2017-18: 41. IP startups - 2013-14: 7, 2014-15: 8, 2015-16: 6, 2016-17: 9, 2017-18: 10

Notable trends

1. Corporate partnerships

The bulk of awards still come from Pharma and Biotech companies (25% of project count). Energy (22%), Industrials (14%) and Technology companies (9%) have overtaken Aerospace & Defence.

Awards from Healthcare Providers punch above their weight with £1.14 million in funding across eight projects. Funding from Medical Device companies was also strong with £1.4 million across 28 projects.

Financial Services companies invested £2.4 million across 23 projects, equating to 4.7% of the total income. The vast majority of our industry partners fall within the wider manufacturing domain (pharma, basic chemicals, turbine engines and aircraft) and Mining / Oil and Gas, with a significant contribution from ICT companies (majority Wireless telecommunications).

2. Inventive output

Invention disclosures have increased by 13% this year. Patent applications filed have also increased, following the steady growth over the last six years.

3. Licensing

The number of new licence agreements signed has stayed steady, along with the cumulative number of active licences held - around 200 over the last four years. Royalty fee income has reduced from £3 million to £1.9 million (the five year average for this figure is £2.3 million). The 2016–17 figure included a large lump licence payment from a notable company exit, making up the majority of the difference.

4. Startups

Startups created: There has been a 178% increase in the number of student startups incorporated, compared with last year. This significant upward trend is driven primarily by post-programme support (in particular, via the Imperial Venture Mentoring Service, business coaching workshops and access to the London ecosystem) and by more sophisticated Enterprise Lab programming (such as the new Venture Catalyst Challenge programme content).

Funding: There has been a large increase in funding for startups (as per the scorecard) - primarily down to some more mature companies raising larger funding rounds, including SAM Labs, CustoMem and Gravity Sketch. Survival rate: A higher number of companies survive the first 12 months of incorporation as a result of the increased level of support offered to post-incorporated companies. Three year survival rate of student startups is currently at 81% compared to the London average of 50.1%.

5. Consulting

There has been a 4% rise in the number of new projects via Imperial Consultants, a 6% rise in number of clients and a continuing trend of increase in new consultants leading projects with a 13% increase on last year.

UK 36.3%, US 14.8%, Netherlands 12.5%, Qatar 6.5%, China 5.8%, France 3.8%, Switzerland 3.5%, Belgium 3.0%, Germany 2.7%, Japan 2.6%, Denmark 1.6%, Malaysia 1.1%, Sweden 1.1%, Korea 0.8%, Israel 0.7%, Norway 0.7%, UAE 0.3%, Brazil 0.3%, Finland 0.3%, Italy 0.3%, Spain 0.3%, Canada 0.2%, Iceland 0.2%, South Korea 0.1%, Australia 0.1%

Technology: 34%, Medical Devices: 17%, Financial Services: 10%, Food & Nutrition: 10%, Basic Materials: 5%, Education: 5%, Pharma & Biotech: 5%, Travel & Leisure: 5%, Consumer: 2%, Energy: 2%, Industrials: 2%, Telecoms: 2%